Additional Child Tax Credit 2020 : Irs 1040 Schedule 8812 Instructions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Right now, filing a tax return for 2020 is the only way to prove to the irs that your child is eligible to receive the credit, meaning that all americans with children should file a return regardless of income. For 2020, the child tax credit. It is in addition to the credit for child and dependent care. This credit effectively gave you a refund if the ctc reduced. For each additional $1,000 of income, the credit is reduced by $50. The additional child tax credit or actc is a refundable credit that you may receive if your child tax credit is greater than the total amount of income taxes you owe, as long as you had an earned income of at least $2,500. The child tax credit is a refundable tax credit of up to $3,600 per qualifying child under 18.

The expanded credit will lift 4.1 million children above. This article has been updated for the 2020 and 2021 calendar and tax years. It is in addition to the credit for child and dependent care. A partial credit is allowed for earners above those limits: The additional child tax credit is refundable, which means you will receive the amount awarded in the form of a tax refund.

2020 tax refund schedule dates.

The additional child tax credit may provide a refundable tax credit. A partial credit is allowed for earners above those limits: So even if your total tax bill is $0, you'll get an additional $1,400 with your tax refund. This article has been updated for the 2020 and 2021 calendar and tax years. The latest stimulus expanded the child tax credit: In fact, nearly 90% of american children will be covered by advance payments of the credit according to the irs. The child tax credit was originally enacted to help working families offset the cost of raising children. We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services. Here is how the expanded child tax credit, increased to $3,000 a child or $3,600 for children under the age of 6, will work. Read on for an overview of the 2020 and 2021 child tax credit, including advice on how to get the rather than functioning like a deduction, the child tax credit operates as a tool that works toward reducing the. The expanded credit will lift 4.1 million children above. And in 2021, you may be able to get some of the child tax credit you are due sooner, in the form of monthly advance payments. Child tax credit and credit for other dependents worksheet. There is a significant difference between tax deductions and tax credits. Families with children got some additional good news in the form of big changes to the child tax changes to the tax code include increasing the value of the credit, making the credit available to.

The child tax credit is a refundable tax credit of up to $3,600 per qualifying child under 18. Most families do not need to do anything to get their advance payment. The american rescue plan makes the credit for 2021 fully refundable. The latest stimulus expanded the child tax credit: This is different from a tax deduction which reduces your taxable income before taxes the child tax credit is only available to taxpayers with earned income of $2,500 or more. The additional child tax credit or actc is a refundable credit that you may receive if your child tax credit is greater than the total amount of income taxes you owe, as long as you had an earned income of at least $2,500. We'd like to set additional cookies to understand how you use gov.uk, remember your settings and improve government services. For 2020 tax returns, which are due by april 15 of this year, the child tax credit is worth $2 they would then claim the additional $4,800 in child tax credits when they file their 2021 federal tax. The child tax credit is worth a maximum of $2,000 per qualifying child. Right now, filing a tax return for 2020 is the only way to prove to the irs that your child is eligible to receive the credit, meaning that all americans with children should file a return regardless of income.

The latest stimulus expanded the child tax credit:

The 2020 and 2021 child tax credit can reduce tax liability by $2,000 per child, amounting to a this differs from a tax deduction, which reduces how much of your income is subject to income tax. 2020 tax refund schedule dates. The child tax credit is a refundable tax credit of up to $3,600 per qualifying child under 18. Tax credits for electric cars. The child tax credit has doubled in recent years and increased its income limits. More families qualify to receive more money. As part of the tax cut & jobs act (tax reform) and american rescue plan act of 2021. (redirected from additional child tax credit). This article has been updated for the 2020 and 2021 calendar and tax years. The additional child tax credit may provide a refundable tax credit. And if the credit reduces your tax obligation to zero, you may also be able to get up to $1,400 of the credit refunded to you as the like all tax credits, the additional child tax credit works by reducing the amount of tax you owe. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. This credit is for individuals who claim a child as a dependent if the child meets additional conditions (described later).

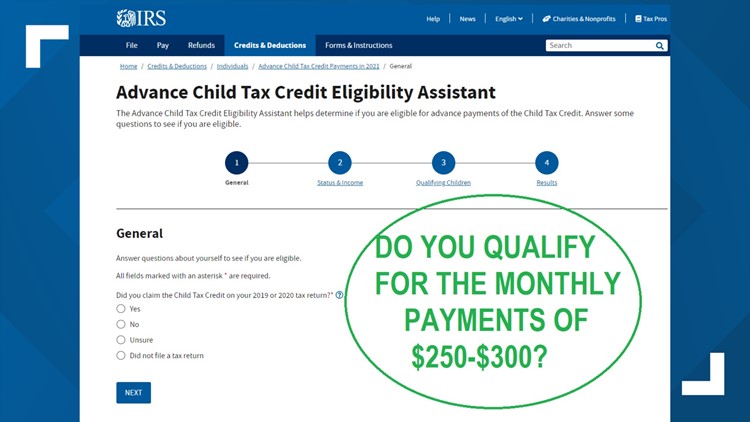

This credit is for individuals who claim a child as a dependent if the child meets additional conditions (described later). And in 2021, you may be able to get some of the child tax credit you are due sooner, in the form of monthly advance payments. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. The american rescue plan makes the credit for 2021 fully refundable. While deductions reduce your taxable income, credits have a dollar value. Changes to the child tax credit for 2021 include increased amounts and advanced payments.

The child tax credit was originally enacted to help working families offset the cost of raising children.

Tax credits for electric cars. It also gives an additional $600 benefit for children under the age of 6 for the 2021 tax year. 2020 & 2021 child tax credit qualifications, maximum credit amounts, agi income phaseouts, additional dependent credit, & more. Those who want to get periodic payments this year need to file returns for 2020, as well as for 2021. Right now, filing a tax return for 2020 is the only way to prove to the irs that your child is eligible to receive the credit, meaning that all americans with children should file a return regardless of income. So even if your total tax bill is $0, you'll get an additional $1,400 with your tax refund. The additional child tax credit is refundable, which means you will receive the amount awarded in the form of a tax refund. The child tax credit for tax year 2020 is only partially refundable. As a tax credit the ctc directly reduces your total tax liability. For 2020 returns, the actc is worth up to $1,400. This does not include investment income, public assistance or. For 2020 and beyond, as much as $1,400 of this credit is refundable. More than 90% of families with children under 18 will get some benefit from the new law, according to estimates by the tax policy center, a joint project of the urban institute and.

The american rescue plan makes the credit for 2021 fully refundable child tax credit 2020. You may be eligible to claim this credit for your here is a breakdown of everything you need to know about the child tax credit and additional child tax credit.

For 2020, the child tax credit.

Since this is not a deduction, you can treat it as cash.

Changes to the child tax credit for 2021 include increased amounts and advanced payments.

The child tax credit is worth a maximum of $2,000 per qualifying child.

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png)

You may be eligible to claim this credit for your here is a breakdown of everything you need to know about the child tax credit and additional child tax credit.

Some tax credits are refundable tax credits, which can increase your tax refund amount if you owe less than the credit amount.

Additional child tax credit (actc).

The american rescue plan makes the credit for 2021 fully refundable.

It is in addition to the credit for child and dependent care.

For 2020 tax returns, which are due by april 15 of this year, the child tax credit is worth $2 they would then claim the additional $4,800 in child tax credits when they file their 2021 federal tax.

So even if your total tax bill is $0, you'll get an additional $1,400 with your tax refund.

For 2020 and beyond, as much as $1,400 of this credit is refundable.

Understanding the additional child tax credit.

For 2020, the child tax credit.

In fact, nearly 90% of american children will be covered by advance payments of the credit according to the irs.

Normally, the irs will calculate the payment amount based on your 2020 tax return.

For 2020 returns, the actc is worth up to $1,400.

The additional child tax credit is refundable, which means you will receive the amount awarded in the form of a tax refund.

Examples of refundable tax credits include the earned income tax credit (eitc), new york city child care tax credit (nyc cctc), child tax credit, additional.

This article has been updated for the 2020 and 2021 calendar and tax years.

By providing a refundable tax credit for families with children, the ctc provides both a lower tax liability for those households with higher incomes and an additional.

A partial credit is allowed for earners above those limits:

This credit is for individuals who claim a child as a dependent if the child meets additional conditions (described later).

The child tax credit is worth a maximum of $2,000 per qualifying child.

In fact, nearly 90% of american children will be covered by advance payments of the credit according to the irs.

Read on for an overview of the 2020 and 2021 child tax credit, including advice on how to get the rather than functioning like a deduction, the child tax credit operates as a tool that works toward reducing the.

In fact, nearly 90% of american children will be covered by advance payments of the credit according to the irs.

For 2020 and beyond, as much as $1,400 of this credit is refundable.

This does not include investment income, public assistance or.

In fact, nearly 90% of american children will be covered by advance payments of the credit according to the irs.

The latest stimulus expanded the child tax credit:

How does the new child tax credit.

The child tax credit is undoubtedly the most common credit that benefits many households.

Posting Komentar untuk "Additional Child Tax Credit 2020 : Irs 1040 Schedule 8812 Instructions 2020 2021 Fill Out Tax Template Online Us Legal Forms"